hawaii capital gains tax calculator

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Hawaii Property Tax Calculator - SmartAsset Calculate how much youll pay in property taxes on your home given your location and assessed home value.

State Taxes On Capital Gains Center On Budget And Policy Priorities

The capital gain tax calculator helps you calculate the tax payable on the below-mentioned assets.

. Our calculator can be used as a short-term capital gain calculator by selecting the duration of the investment. Compare your rate to the Hawaii and. 2022 Capital Gains Tax Calculator Use this tool to estimate capital gains taxes you may owe after selling an investment property.

On the next page you will be able to add more details like itemized. The amount you can be taxed on the short-term capital gains depends on your. Hawaii Income Tax Calculator 2021 If you make 70000 a year living in the region of Hawaii USA you will be taxed 14386.

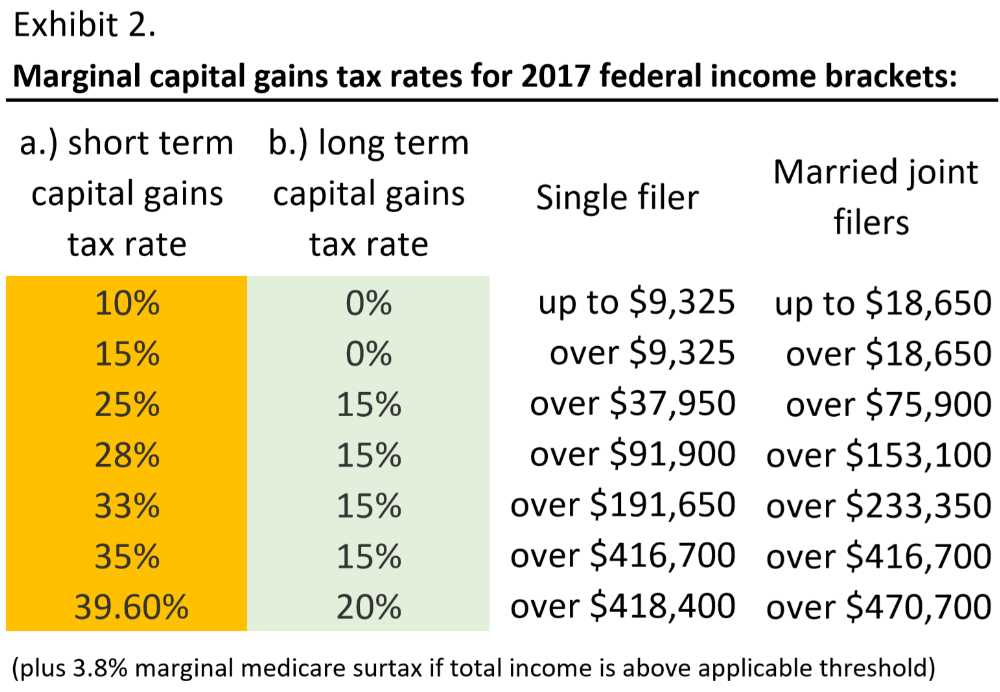

Web 2022 State Capital Gains Rates Income Tax Rates and 1031 Exchange Investment. You are able to use our Hawaii State Tax Calculator to calculate your total tax costs in the tax year 202122. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets.

Hawaiis capital gains tax rate is 725. Using a capital gains tax calculator will help you determine the total tax you need to pay on any profit known as capital gain youve earned through the sale of an asset. That applies to both long- and short-term capital gains.

You may have a capital gain or loss when you sell a capital asset such as real estate stocks or bonds. Our real estate capital. You can use our free Hawaii income tax calculator to get a good estimate of what your tax liability will be come April.

2021 Hawaii State Sales Tax Rates The list below details the localities in Hawaii with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Your average tax rate is 1198 and your marginal tax rate. Web Our capital gains tax calculator.

Our calculator has recently been updated to include both the latest Federal Tax. Web Hawaiis capital gains tax rate is 725. Capital Gains Tax in Hawaii In Hawaii long-term capital gains are taxed at a.

Long-term capital gains constitute 115 percent of total taxable income in the state or nearly 43 billion in 2019. Capital gains and losses are taxed differently from income like wages. If Hawaiʻi were to tax capital gains at the same rates as regular income as.

How to use Scripboxs capital gain tax calculator. This handy calculator helps you avoid tedious number. Hawaii taxes capital gains at a maximum rate of 725.

You are able to use our Hawaii State Tax Calculator to calculate your total tax costs in the tax year 202223.

Hawaii Income Tax Hi State Tax Calculator Community Tax

2022 Capital Gains Tax Rates By State Smartasset

Hawaii Income Tax Hi State Tax Calculator Community Tax

State Capital Gains Tax Which States Have The Highest Taxes Michael Ryan Money

State Income Taxes Highest Lowest Where They Aren T Collected

Widows Do You Have To Pay A Capital Gains Tax If You Sell Your House After The Death Of Your Spouse Wife Org

Hawaii Income Tax Hi State Tax Calculator Community Tax

Easiest Capital Gains Tax Calculator 2022 2021

Capital Gains Tax Rates By State Nas Investment Solutions

United States Where Can I See The Local Tax Rates On Capital Gains Personal Finance Money Stack Exchange

Real Estate Tax Benefits The Ultimate Guide

Calculating Capital Gains Tax On The Sale Of A Collectible

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

Capital Gains Tax Calculator 1031 Crowdfunding

State Capital Gains Tax Which States Have The Highest Taxes Michael Ryan Money

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Hawaii Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition